Transforming Private Equity: AI’s Role in Deal Sourcing, Value Creation, and Exits

Written by

Jacob Zweig, Managing Director

Published

August 14, 2024

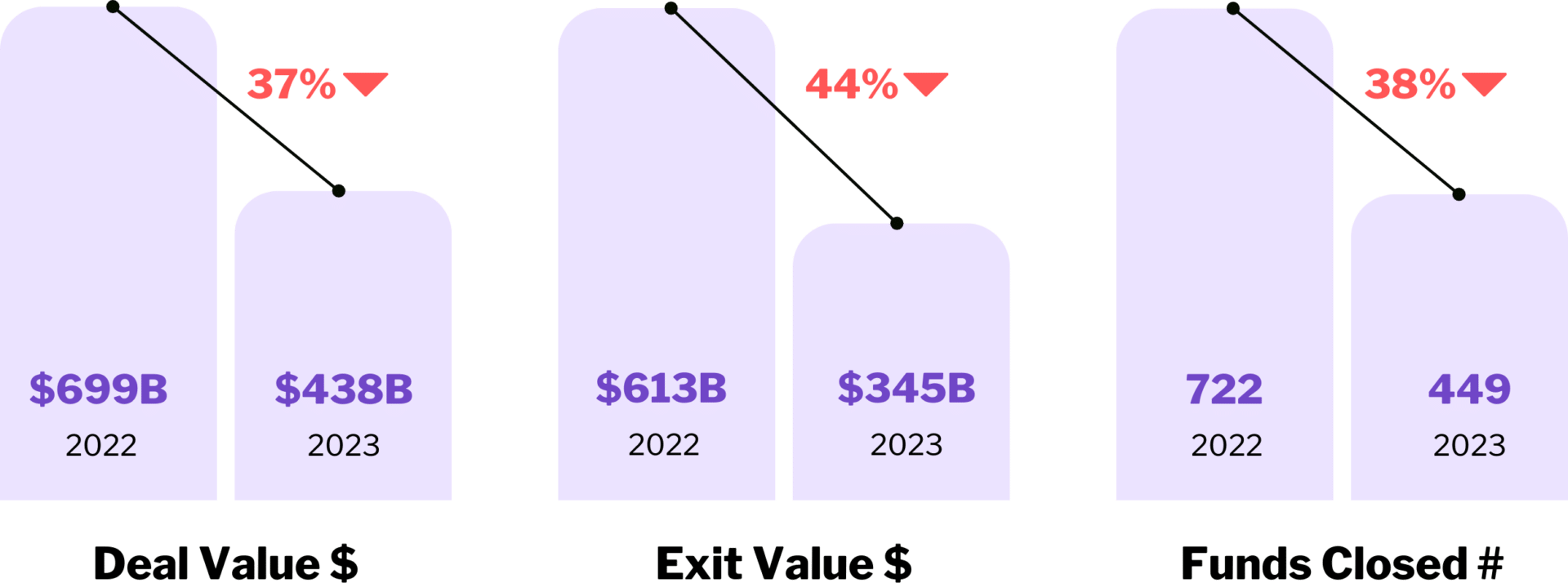

For private equity firms, the rapid rise in interest rates and heightened competition in 2023 has resulted in sharp declines in deal-making, exits, and fund-raising. According to Bain & Company’s 2024 Global Private Equity Report, these market conditions have led to a significant amount of capital sitting on the sidewalks, a high number of unexited assets, increased pressure to generate EBITDA, and investors are seeking “safer” investments.

To successfully navigate the current landscape of the PE industry, firms must excel in three critical areas: Deal Sourcing, Value Creation, and Exit Strategy. Leveraging Artificial Intelligence (AI) can help PE firms increase speed and efficiency across these three areas.

1. Deal Sourcing

Effective deal sourcing is the cornerstone of successful private equity operations. Traditionally, this process involves building robust networks with industry experts, brokers, and advisors to access lucrative deals at the earliest stages. However, with the advent of AI, this landscape is changing dramatically.

AI Use Cases for Deal Sourcing:

Unified Portfolio Analytics & Market Analysis

AI can scan vast amounts of data to identify potential opportunities, perform detailed due diligence, and develop accurate valuation strategies.

Targeted Outreach

AI-driven tools can generate personalized email drafts, ensuring that firms connect with the right contacts at the right time.

Deal Prioritization

- AI helps prioritize deals based on strategic fit and potential ROI, reducing the risk of missing out on high-value opportunities.

Efficiency & Accuracy

The use of AI accelerates the deal sourcing process and increases the likelihood of identifying high-potential investments.

2. Value Creation

In private equity, rapidly improving EBITDA is crucial for driving growth and maximizing returns. AI plays a pivotal role in enhancing portfolio value creation by optimizing various operational aspects.

AI Use Cases for Value Creation:

Demand Forecasting

AI can predict future demand trends, enabling firms to make informed decisions on inventory, production, and resource allocation, ultimately driving revenue growth.

Customer Segmentation

By analyzing customer data, AI can identify distinct segments, allowing firms to tailor their strategies and offerings to meet the specific needs of different groups, enhancing customer satisfaction and loyalty.

Cost Reduction & Pricing Strategies

Advanced analytics powered by AI drive cost reduction initiatives and improve pricing strategies.

Uncovering Hidden Opportunities

AI analyzes unstructured data to provide insights into customer behavior, market dynamics, and operational performance, leading to innovative growth strategies.

3. Exit Strategy

A well-planned exit strategy is essential for realizing the full value of an investment. AI-driven insights elevate this process to new heights.

AI Use Cases for Exit Strategy:

Market Trends & Buyer Identification

AI analyzes market trends and identifies potential buyers, ensuring firms are well-prepared for exits.

Valuation Model Refinement

AI refines valuation models, providing more accurate and data-backed assessments.

Stakeholder Alignment & Smooth Transitions

NLP tools analyze communication patterns and stakeholder sentiment, aiding effective engagement and negotiation strategies.

Timing Optimization

Predictive analytics forecast industry trends and buyer behavior, helping firms time their exits for maximum return.

Streamlined Due Diligence

AI streamlines the due diligence process for potential buyers, making the firm’s exit offering more attractive.

Maximizing Portfolio Value

with Data & AI

The intersection of data and AI is continuing to shape the business landscape. For private equity firms, leveraging data and AI is a necessity for driving value creation and operational efficiency in portfolio companies. Check out our playbook that guides private equity firms and their portfolio companies through seven essential components of a robust data and AI strategy, helping achieve and maintain data maturity.