Assessing Data Maturity in Private Equity: From Data Dabblers to AI Advocates

Written by

Mike Galvin, CEO & Co-Founder

Published

April 18, 2024

Private equity firms are increasingly recognizing the importance of leveraging data to drive portfolio insights and mitigate investment risks. The journey towards data maturity in the private equity sector is not just about adopting the latest technologies; it’s about strategically navigating through various stages, each unlocking new opportunities for growth and innovation.

Whether your firm is just beginning its data integration journey or poised for advanced analytics adoption, understanding your current state is vital for crafting tailored strategies aligned with your organizational goals. Take our data maturity assessment to understand where your firm stands today and what you need to do to get to the next level.

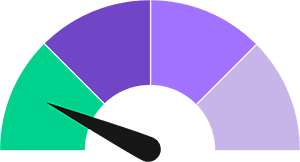

Stage 1: Data Dabbler

At the initial stage of the journey, private equity firms are akin to data dabblers, just dipping their toes into the vast ocean of data possibilities. For portfolio companies, this stage involves implementing basic data management platforms to centralize data, conducting quality audits, and investing in analytics training. Establishing a data governance committee ensures alignment across departments and compliance with regulations like GDPR and CCPA.

For the private equity firm itself, adopting advanced analytics platforms for portfolio-wide performance tracking is essential. Standardizing data collection processes and investing in data-centric training for staff set the groundwork for future advancements.

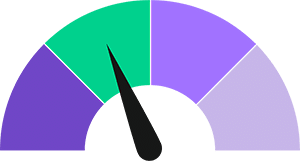

Stage 2: Analytics Apprentice

As firms progress to the Analytics Apprentice stage, they delve deeper into data-driven decision-making. Portfolio companies implement advanced analytics platforms and establish protocols for data-driven decision-making. Automation becomes a key focus, optimizing repetitive tasks and workflows through data insights.

Within the private equity firm, aligning data strategy with business objectives and effectively communicating it across the organization is crucial. Leveraging data talent effectively and addressing resistance to change are vital for successful advancement to the next stage.

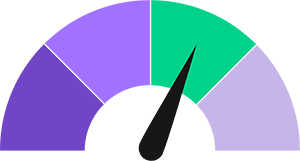

Stage 3: Centralization Champion

In the Centralization Champion stage, the focus shifts towards centralizing data and ensuring interoperability across systems. Portfolio companies adopt data integration platforms and invest in interoperable technologies to bridge legacy and modern systems. Data standardization initiatives ensure consistency across all sources.

For the private equity firm, robust data aggregation processes and quality assurance measures become paramount. Providing resources and support for portfolio companies to navigate regulatory compliance requirements is essential for success.

Stage 4: AI Advocate

At the pinnacle of the journey lies the AI Advocate stage, where firms fully embrace the power of artificial intelligence. Portfolio companies invest in AI-ready infrastructure and implement data labeling processes to ensure high-quality training data. Training programs and incentives attract and retain AI talent within the organization.

For the private equity firm, developing a comprehensive AI strategy aligned with business objectives is critical. Robust data governance frameworks ensure ethical and responsible AI use, fostering a culture of innovation and continuous improvement.

Your journey starts with a data maturity assessment.

Navigating the path towards data centralization can be daunting, especially for private equity firms facing diverse challenges in managing their data effectively. If you’re unsure where to begin, understanding your firm’s current data maturity level is the crucial first step. Complete the 8-question assessment and immediately get your firm’s data maturity score and ranking, along with recommendations for how to get to the next level.

Take the Assessment