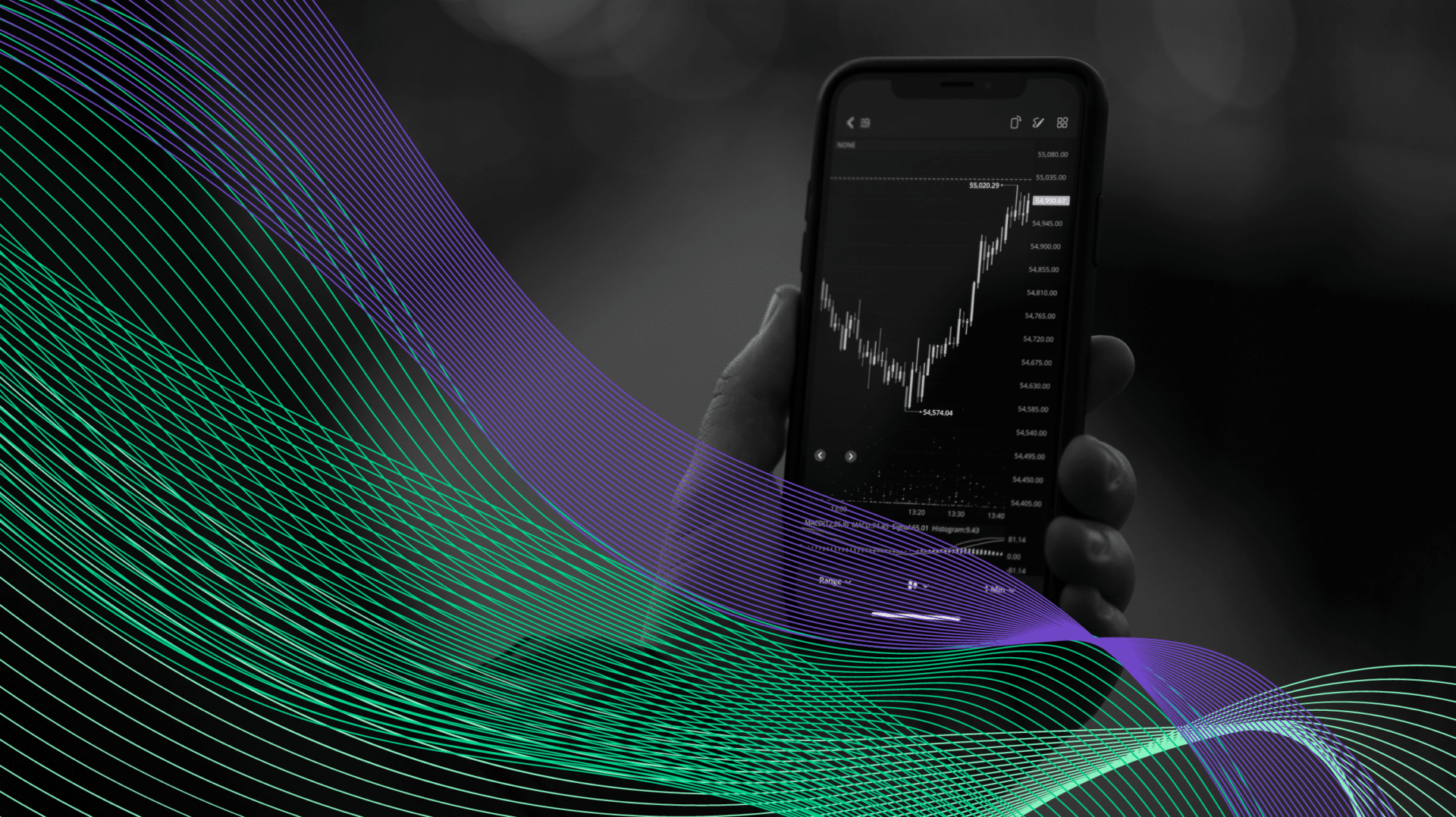

Top 10 Data & AI Trends Private Equity Firms Should Watch in 2024

Written by

Mike Galvin, Managing Director

Published

August 1, 2024

As we navigate through 2024, the landscape of data and artificial intelligence (AI) continues to evolve at a rapid pace. For private equity firms, staying ahead of these trends is crucial for making informed investment decisions, optimizing portfolio company performance, and driving value creation. Here are the top data and AI trends that private equity firms should keep an eye on this year.

1. Generative AI and Large Language Models (LLMs)

Generative AI and large language models, such as OpenAI’s GPT-4, are revolutionizing the way businesses operate. These models are capable of generating human-like text, which can be used in a variety of applications from content creation to customer service automation. According to a report by Gartner, the use of AI in content creation is expected to grow by 30% by 2024. Private equity firms can leverage these technologies to enhance marketing efforts, streamline communication processes, and improve decision-making through advanced data analysis.

Source: Gartner “Predictive Analytics Market Research Report”

2. AI-Driven Predictive Analytics

Predictive analytics has become a cornerstone for data-driven decision-making. With advancements in AI, predictive models are now more accurate and capable of processing vast amounts of data in real-time. According to McKinsey, companies that use predictive analytics report a 20-25% increase in their overall performance. Private equity firms can use AI-driven predictive analytics to forecast market trends, identify potential investment opportunities, and mitigate risks by anticipating financial downturns or market shifts.

Source: McKinsey & Company “The Value of Predictive Analytics”

3. Edge AI and IoT Integration

The integration of AI with Internet of Things (IoT) devices is creating new opportunities for data collection and analysis at the edge of networks. Edge AI allows for real-time processing of data on devices such as sensors and cameras, reducing latency and improving efficiency. IDC predicts that by 2025, 75% of enterprise-generated data will be created and processed at the edge. Private equity firms investing in industries like manufacturing, healthcare, and logistics should watch for advancements in edge AI to capitalize on improved operational efficiencies and innovative business models.

Source: IDC “Edge Computing and IoT Market Forecast”

4. AI Ethics and Governance

As AI becomes more pervasive, the need for robust ethics and governance frameworks is increasingly important. Regulatory bodies around the world are beginning to implement stricter guidelines to ensure AI is used responsibly and ethically. A PwC survey found that 85% of CEOs believe AI ethics and governance will be critical to gaining public trust. Private equity firms must prioritize investments in companies that adhere to ethical AI practices and have strong governance structures in place to avoid regulatory pitfalls and maintain public trust.

Source: PwC “AI Ethics and Governance Survey”

5. AI in Cybersecurity

Cybersecurity remains a top concern for businesses across all sectors. AI is playing a crucial role in enhancing cybersecurity measures by detecting threats in real-time, automating response actions, and predicting potential vulnerabilities. According to a report by Capgemini, 69% of organizations believe AI will be necessary to respond to cyber threats. Private equity firms should consider the cybersecurity capabilities of their portfolio companies and look for investment opportunities in AI-driven cybersecurity solutions to safeguard assets and data integrity.

Source: Capgemini “AI in Cybersecurity Report”

6. Sustainable AI and Green Technology

Sustainability is becoming a key focus area for investors and businesses alike. AI is being used to drive sustainable practices across various industries, from optimizing energy consumption to improving supply chain efficiencies. A study by Accenture found that AI has the potential to boost renewable energy efficiency by up to 20%. Private equity firms should monitor advancements in sustainable AI and green technologies, as these can offer both financial returns and positive environmental impact, aligning with the growing demand for ESG (Environmental, Social, and Governance) investments.

Source: Accenture (2023) “AI and Sustainability Report”

7. AI-Powered Automation and Workforce Transformation

Automation driven by AI is transforming the workforce landscape. From robotic process automation (RPA) to AI-driven customer service bots, businesses are increasingly adopting automation to enhance productivity and reduce costs. According to Deloitte, 58% of business leaders have implemented some form of AI automation, and this number is expected to grow. Private equity firms need to understand the implications of AI-powered automation on workforce dynamics and consider investing in companies that are leading the way in innovative workforce transformation.

Source: Deloitte “AI-Powered Automation Adoption Survey”

8. AI in Healthcare and Life Sciences

The healthcare and life sciences sectors are experiencing significant advancements due to AI. From drug discovery to personalized medicine, AI is enabling breakthroughs that were previously unimaginable. The AI in healthcare market is projected to reach $45.2 billion by 2026, growing at a CAGR of 44.9% from 2021. Private equity firms should keep a close watch on AI developments in these sectors, as they present lucrative investment opportunities with the potential to drive significant societal impact.

Source: MarketsandMarkets “AI in Healthcare Market Forecast”

9. Quantum Computing and AI

Quantum computing is still in its early stages, but its potential to revolutionize AI and data analytics is immense. Quantum computers can process complex calculations at unprecedented speeds, which could lead to breakthroughs in areas such as cryptography, material science, and large-scale data analysis. According to a report by Boston Consulting Group, the quantum computing market is expected to reach $850 billion by 2040. Private equity firms should stay informed about advancements in quantum computing and consider the long-term implications for AI and data strategies.

Source: Boston Consulting Group “Quantum Computing Market Analysis”

10. AI-Enhanced Customer Experience

Enhancing customer experience through AI is becoming a competitive differentiator for businesses. AI-powered chatbots, personalized recommendations, and predictive customer analytics are just a few examples of how AI is being used to improve customer satisfaction and loyalty. According to Salesforce, 57% of customers are willing to share personal data in exchange for personalized offers or discounts. Private equity firms should look for investment opportunities in companies that are leveraging AI to deliver superior customer experiences, as this can drive growth and profitability.

Source: Salesforce”State of the Connected Customer Report”

Maximizing Portfolio Value

with Data & AI

The intersection of data and AI is continuing to shape the business landscape. For private equity firms, leveraging data and AI is a necessity for driving value creation and operational efficiency in portfolio companies. Check out our playbook that guides private equity firms and their portfolio companies through seven essential components of a robust data and AI strategy, helping achieve and maintain data maturity.