- Financial Services

Modernizing data architecture to unlock business insights for a financial services firm

Overview

Transforming data management to drive operational excellence

A financial services firm specializing in ETF investment and technology platforms faced challenges in managing its data across multiple sources. The absence of a unified and scalable data platform hindered efficient reporting, data quality, and visibility into performance metrics, limiting the ability to meet both internal and external demands. The client sought to establish a robust data platform to support diverse use cases, streamline operations, and improve decision-making.

The goals of the project included:

- Creating a centralized and scalable data platform for real-time reporting and insights.

- Enabling seamless integration of data from internal and external sources.

- Improving operational efficiency through automated reporting and analytics.

The client chose OneSix for its expertise in data architecture, cloud technologies, and demonstrated success in delivering similar solutions within the financial services industry.

Our Solution

Modern architecture and automation for seamless data management

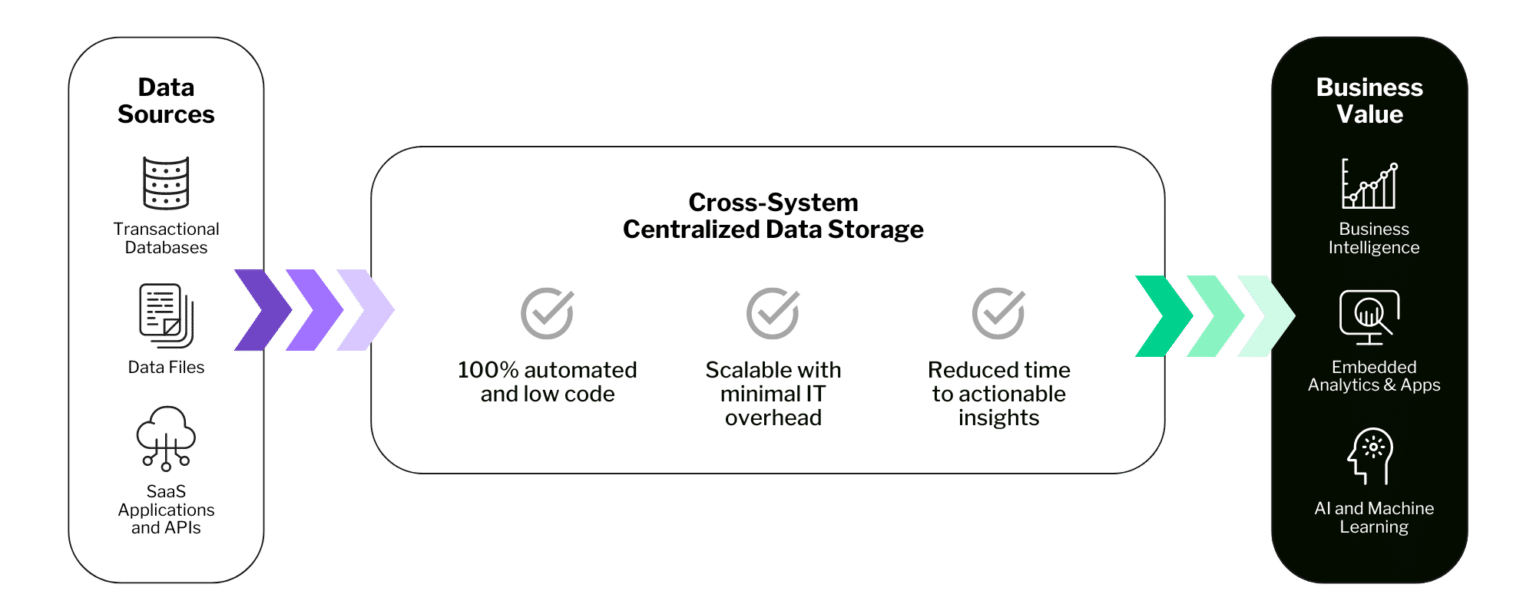

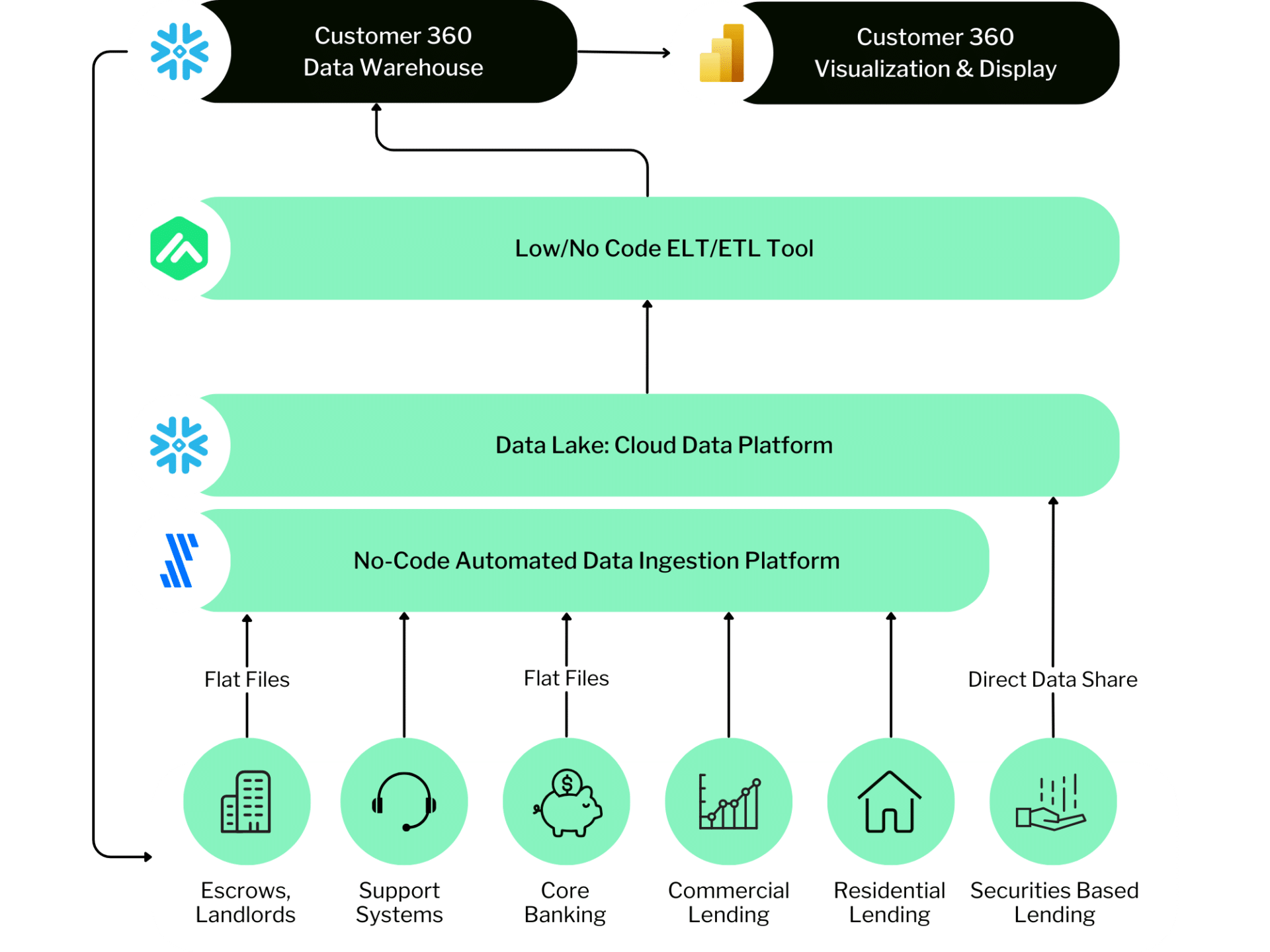

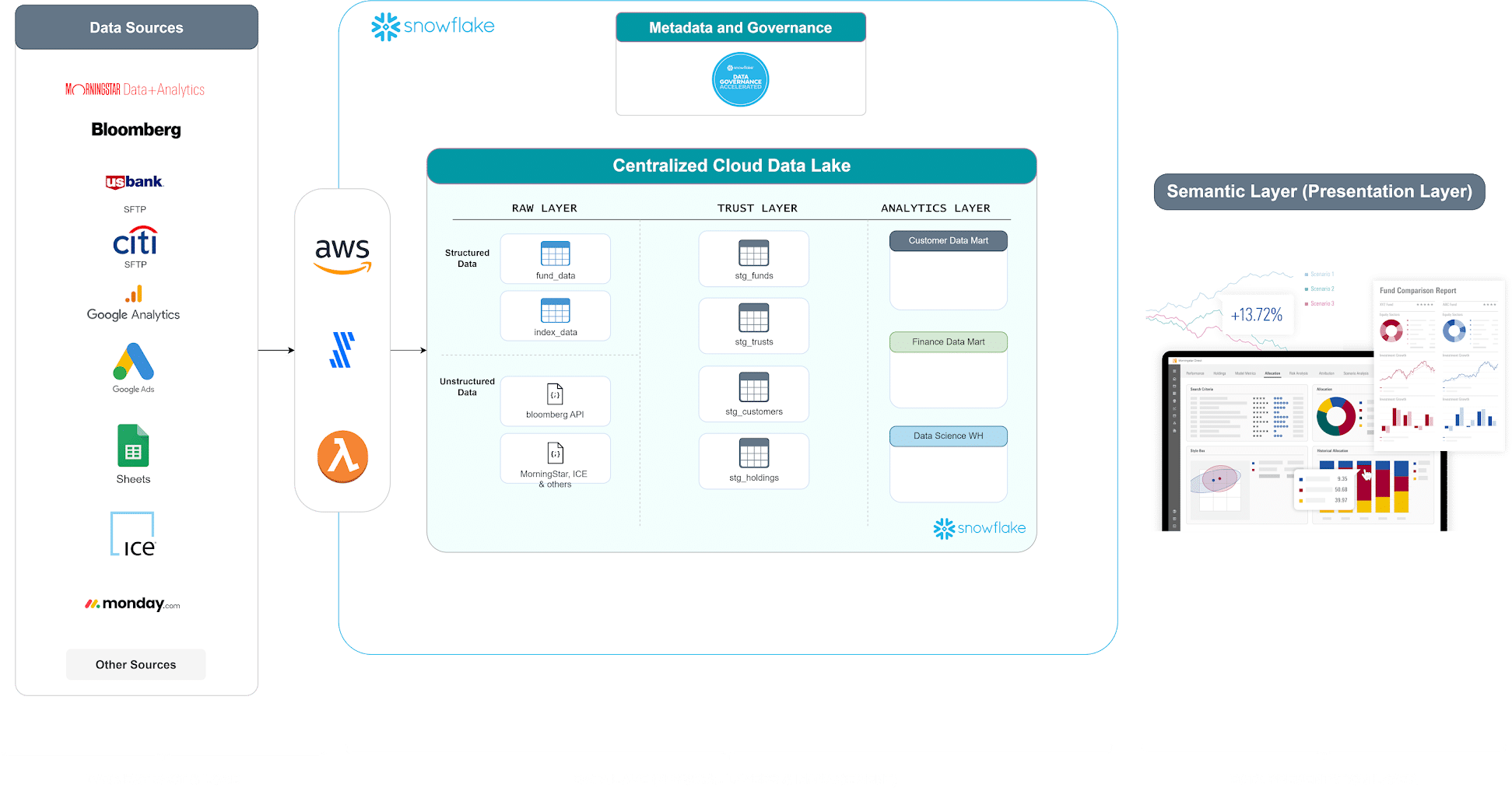

OneSix implemented a comprehensive solution leveraging modern data architecture principles and cutting-edge technologies—including Snowflake, dbt Core, Fivetran, Matillion, and Sigma—to address the client’s data management challenges.

The project unfolded in three distinct phases:

Phase 1: Data Ingestion

- Conducted discovery and strategy sessions to assess requirements and define the architecture.

- Designed a secure and scalable data platform architecture using Snowflake.

- Built a data lake to support ingestion from over 50 data sources.

- Implemented dbt Core with Matillion for automated ETL pipelines and robust data quality tests.

Phase 2: Portal Build

- Selected and implemented advanced ETL tools for efficient data transformation.

- Developed a data warehouse for AUM (Assets Under Management) reporting and analytics.

- Created an internal portal to provide teams with real-time insights into ETF performance through consolidated dashboards.

Phase 3: Additional Reporting

- Automated 13F filings for compliance with SEC reporting rules, reducing manual effort and improving accuracy.

- Built automated reporting for fund administration, legal registration statements, and board reports.

- Integrated the data lake with external systems to facilitate seamless data sharing with third parties.

Results

Improved efficiency, compliance, and operational visibility

The implementation of the scalable data platform delivered measurable impact across key areas of the business:

- Streamlined Operations: Ingested data from over 53 sources into a centralized data lake and warehouse, supporting consistent daily reporting.

- Increased Efficiency: Automated AUM reporting and SEC filings, significantly reducing manual effort and ensuring regulatory compliance.

- Improved Data Quality: Applied rigorous data validation using dbt Core and Matillion to maintain accuracy and consistency.

- Real-Time Insights: Deployed internal portals and dashboards for up-to-date visibility into ETF performance.

- Time & Cost Savings: Automated 13F filings, reducing errors and freeing up team resources.

- Expanded Capabilities: Integrated with external systems to enable secure, scalable data sharing.

With a modern, automated data foundation in place, the client now benefits from faster decision-making, improved compliance, and a platform built to support ongoing innovation and growth.

Ready to unlock the full potential of data and AI?

Book a free consultation to learn how OneSix can help drive meaningful business outcomes.