- Financial Services

Building a Customer 360 data solution for Leader Bank

Overview

Overcoming data silos to gain a unified view of customers

To maintain a competitive edge, community banks need to have a deep understanding of customer behavior and preferences. Leader Bank, like many financial institutions, faced a common challenge: fragmented systems and data silos. They had separate platforms for commercial lending, residential lending, and core banking operations, with little interaction between them. This siloed approach made it incredibly difficult to establish a comprehensive view of their customers.

Back-office processes were cumbersome, and customer support teams found it challenging to provide efficient service due to a lack of unified customer data. To compound matters, data quality issues, including inconsistent naming conventions and formats, added complexity to the situation.

Our Solution

Implementing a Customer 360 platform with a cloud-based infrastructure

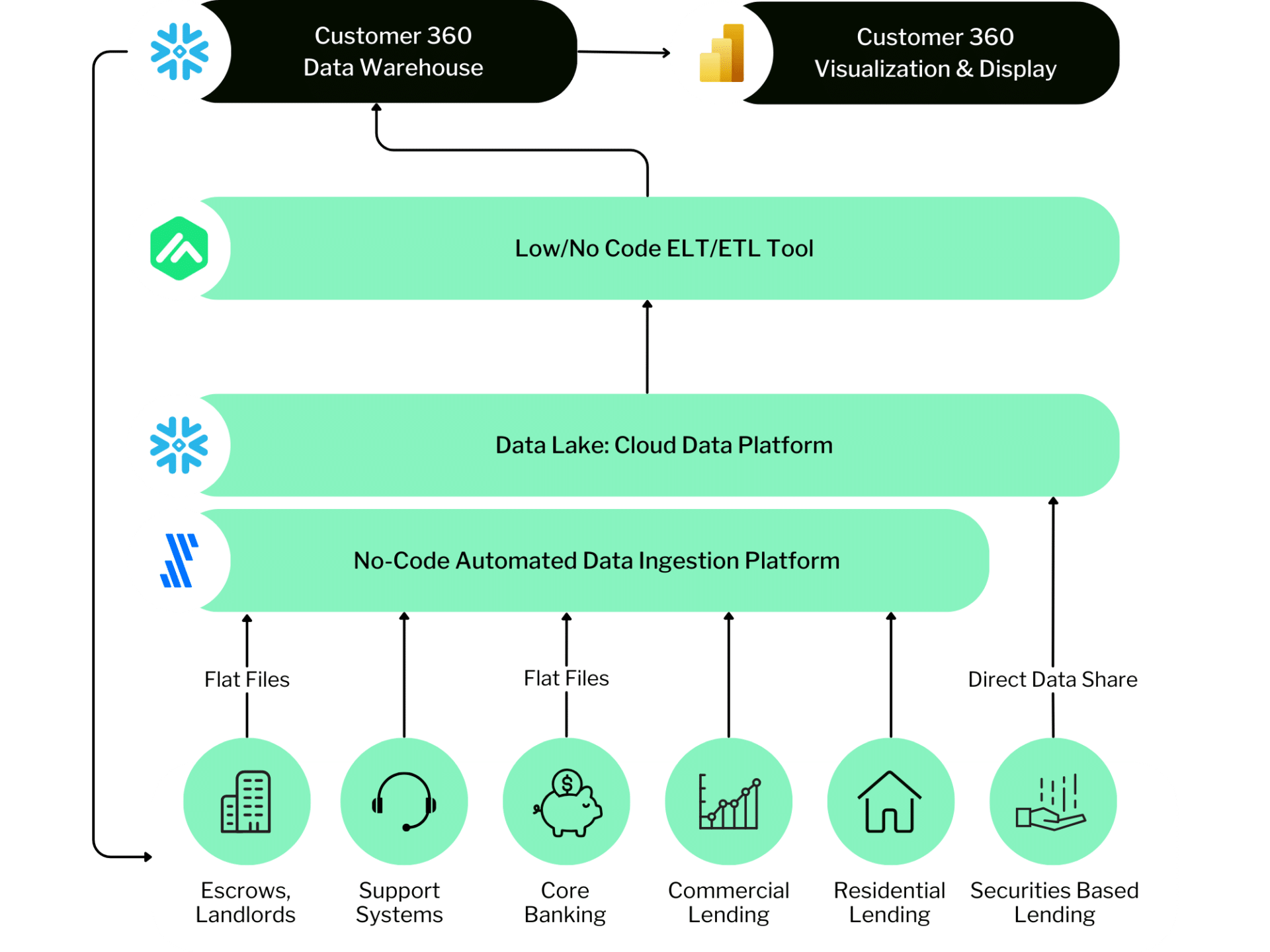

OneSix partnered with Leader Bank to tackle these issues head-on, devising a comprehensive solution that aimed to provide a holistic view of each customer. The key components of this solution included:

- Master Data Management (MDM) Strategy: OneSix developed a robust MDM strategy to standardize data across the organization, ensuring consistent naming conventions and formats. This laid the foundation for accurate data integration.

- Cloud-Based Data Infrastructure: To create a unified platform for customer data, OneSix implemented a cloud-based data lake and data warehouse. This allowed for the storage and processing of vast amounts of data from different systems in a scalable and cost-effective manner.

- Rules Engine: A rules engine was introduced to automate data validation, cleansing, and transformation. This ensured that data was accurate, up-to-date, and adhered to the defined standards.

The goal of these components was to establish a common data platform where information from various systems could seamlessly integrate. This would enable Leader Bank to tie together customer interactions, track their history, and gain valuable insights for personalized marketing and improved customer service.

Technologies Implemented

- Snowflake served as the host to collect data into the data lake across various systems. A C360 data warehouse served the BI and Customer information needs of this bank.

- Fivetran was used to capture data across a variety of data sources to move data into the data lake. In addition, Snowflake Data Share provided access to raw data for a Snowflake-based system.

- Matillion was used as the rules engine to cleanse data and provide match/merge rules for the customer record and transform that into the data warehouse.

- PowerBI was used to drive analytics and display Customer 360 information across the institution.

Results

Enhanced customer service, data-driven marketing, and operational efficiency

The implementation of the Customer 360 solution brought about significant positive changes:

- Improved Customer Service: With a unified view of customer data, the bank’s support teams could quickly identify callers and access their interaction history. This streamlined the support process, leading to improved service and reduced call handling time.

- Data-Driven Marketing: To create a unified platform for customer data, OneSix implemented a cloud-based data lake and data warehouse. This allowed for the storage and processing of vast amounts of data from different systems in a scalable and cost-effective manner.

- Enhanced Data Quality: The MDM strategy and rules engine led to improved data quality. Data inconsistencies were eliminated, resulting in more reliable and accurate information for decision-making.

- Increased Efficiency by 2X: Back-office processes were streamlined, reducing operational inefficiencies. This led to cost savings and increased productivity across the organization.

- Increased Customer Satisfaction: With improved service and personalized experiences, customers were more satisfied, leading to stronger customer loyalty and potential for business growth.

Ready to unlock the full potential of data and AI?

Book a free consultation to learn how OneSix can help drive meaningful business outcomes.