Achieving True Customer 360 from Scratch in Record Time

Written by

Faisal Mirza, VP of Strategy

Published

July 13, 2023

In today’s data-driven world, organizations across industries face the challenge of managing customer data scattered across multiple systems. The lack of a unified view of customer information often leads to inefficiencies, data inconsistencies, and missed opportunities. In a recent webinar, Faisal Mirza, Vice President of Strategy at OneSix, showcased the implementation of a customer 360 solution for a leading mid-sized bank in New England. He highlights the challenges faced by the bank, the solution implemented, and the remarkable outcomes achieved.

Challenges Faced by the Bank

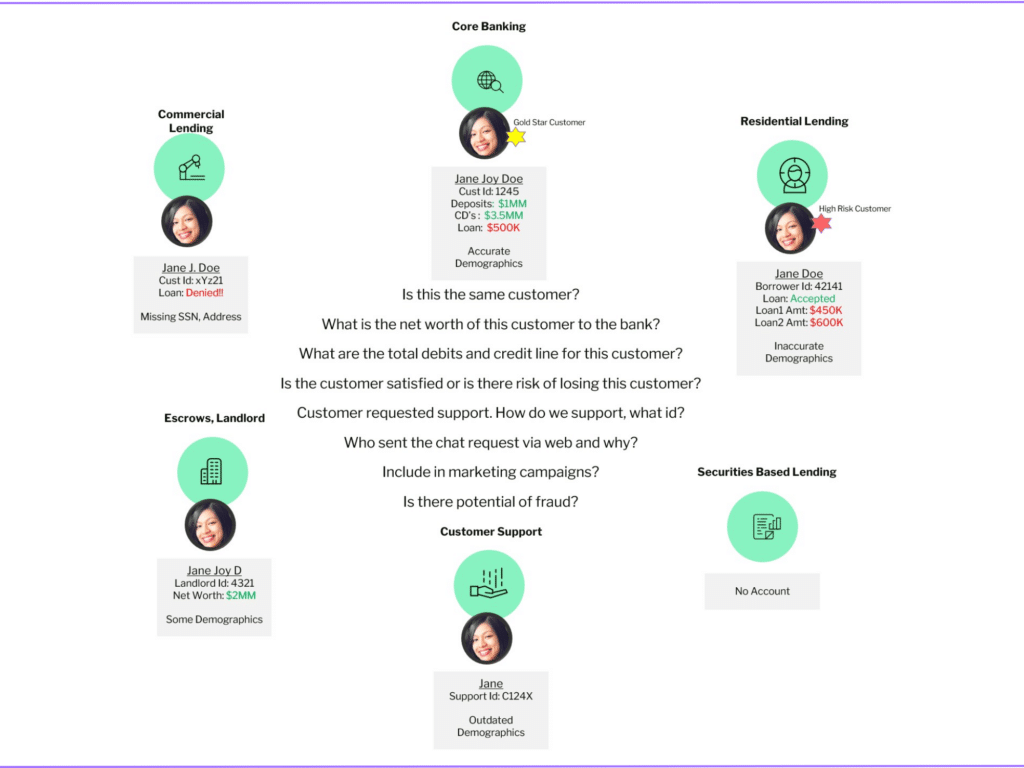

The banking client approached OneSix with several challenges. Their existing systems were fragmented, with separate platforms for commercial lending, residential lending, and core banking operations. This siloed approach resulted in a lack of interaction between systems, making it difficult to identify and link customer information accurately. Back-office processes were cumbersome, and customer support teams struggled to provide efficient service due to a lack of comprehensive customer data. Additionally, data quality issues, such as inconsistent naming conventions and formats, further complicated the situation.

The Customer 360 Solution

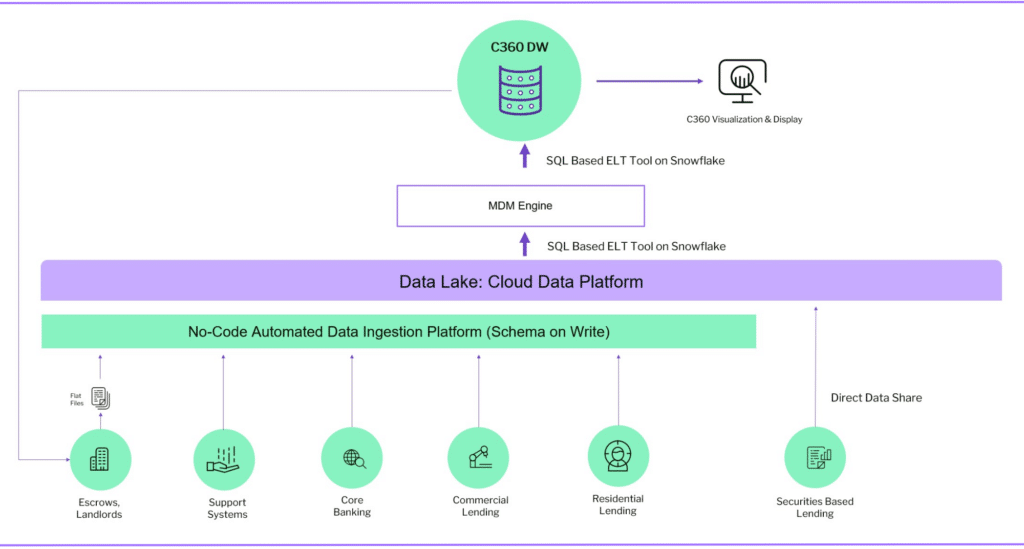

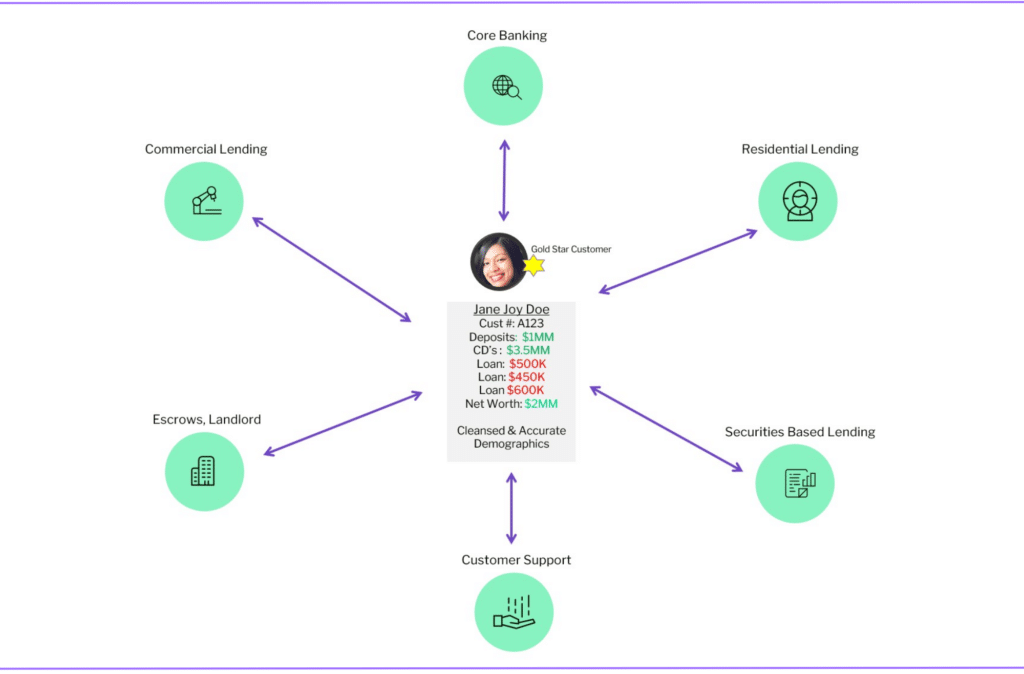

To address these challenges, OneSix partnered with the bank to develop a robust customer 360 solution. The solution aimed to provide a holistic view of each customer by integrating data from the various systems into a unified platform. By establishing a common data platform, the bank could tie together customer interactions, track their history, and gain valuable insights for personalized marketing and improved customer service.

The Implementation Process

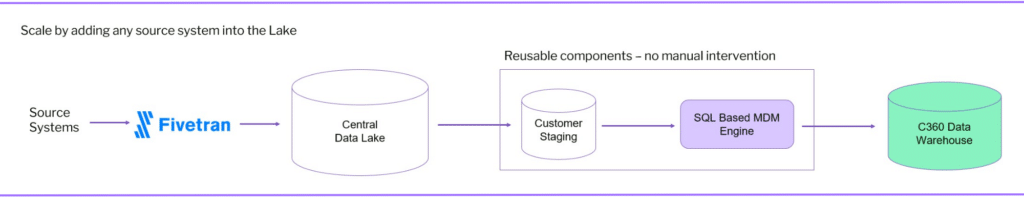

The project faced several constraints, including a limited budget, a small team, and a tight timeline. Despite these challenges, OneSix adopted an agile approach and leveraged the team’s expertise to devise an efficient solution. They utilized cloud technology, including Snowflake and Fivetran, to bring together data from multiple systems.

By leveraging Fivetran for data ingestion and transformation, they streamlined the process and ensured accurate and timely data integration. The resulting customer 360 data warehouse provided a comprehensive view of each customer, including their demographics, interactions, accounts, and collateral.

Benefits and Success

The implementation of the customer 360 solution yielded significant benefits for the bank. With a unified view of customer data, customer support teams could quickly identify callers and access their interaction history, leading to improved service and reduced call handling time. The marketing team gained valuable insights to drive targeted campaigns and personalized offers. The bank also witnessed enhanced data quality, streamlined processes, and increased customer satisfaction.

Lessons Learned and Recommendations

Throughout the implementation process, OneSix emphasized their collaborative partnership with the bank. They highlighted the importance of selecting the right tools and technologies aligned with the organization’s goals and strategies. Their modular approach allowed for scalability, ensuring that future expansions and system integrations would be seamless. They emphasized the significance of a well-defined data strategy and roadmap for organizations looking to embark on similar customer 360 initiatives.

The Power of Customer 360

The success of the customer 360 solution showcased in this webinar demonstrates the power of integrating customer data from disparate systems into a unified platform. By leveraging cloud data platforms, data integration tools, and a collaborative approach, organizations can overcome data fragmentation challenges and achieve a holistic view of their customers.

Get Started

OneSix helps companies build the strategy, technology and teams they need to unlock the power of their data.