- Financial Services

Building a forecasting engine and media mix modeling pipeline for a FinTech firm

Overview

Improving marketing efficiency in a fast-growing financial services firm

A rapidly expanding firm in the consumer financial services industry, offering both traditional and cryptocurrency brokerage solutions, faced challenges with low and declining Return on Ad Spend (ROAS), estimated at 0.5-0.8x.

Despite impressive growth driven by a surge in interest in stock and alternative assets since 2020, the company’s marketing spend had consistently outpaced revenue. OneSix was tasked with implementing machine learning and data science solutions to enhance marketing efficiency by accurately measuring spend effectiveness and building an automated pipeline for optimized media allocation.

Our Solution

Building a marketing efficiency and optimization platform

To tackle the client’s challenge, OneSix developed two custom models designed to provide insights into current marketing spend efficiency and inform future optimization strategies:

LifeTime Value (LTV) Model

OneSix created a predictive LTV model capable of forecasting each newly acquired user’s value within 12 hours of signup. This model offered near real-time insights into customer acquisition health by forecasting future revenue over multiple time horizons for users and cohorts. Integrating this model with direct attribution data from the client’s Mobile Measurement Provider (MMP) and custom attribution logic enabled precise calculations of Customer Acquisition Costs (CAC) at both user and cohort levels. The model decomposed LTV predictions into key metrics like time-to-convert, time-to-churn, subscription revenue, and non-subscription revenue. This breakdown highlighted specific channel performance issues, revealing, for instance, that some channels suffered from retention issues while others had low conversion rates.

Media Mix Model (MMM)

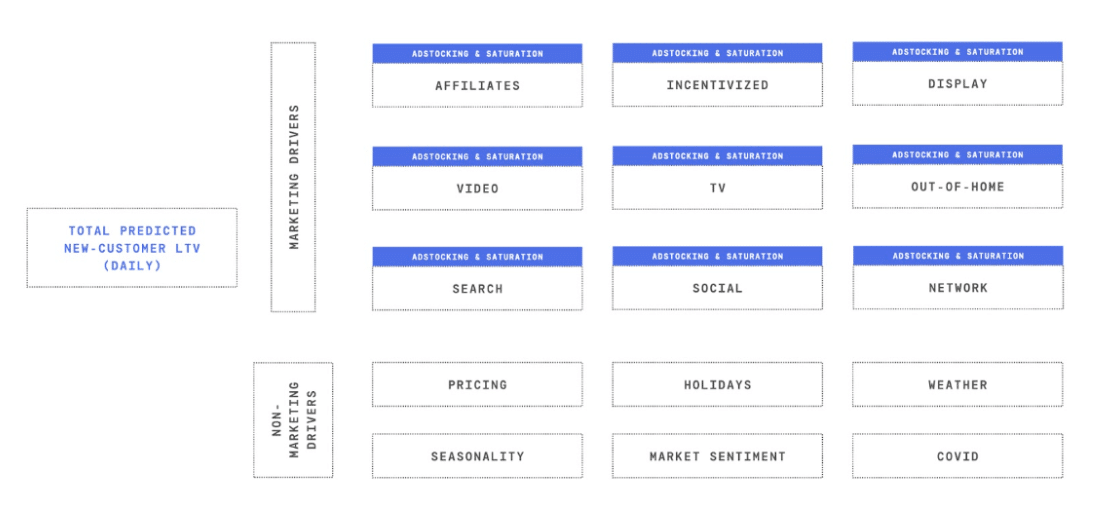

OneSix also developed a Media Mix Model (MMM) that used historical LTV estimates and spend data to calculate the LTV/Spend (ROAS) ratio for each marketing channel. The MMM accounted for marketing and non-marketing factors, including market sentiment, seasonality, holidays, and product/pricing changes. By optimizing for aggregate forecasted LTV rather than short-term metrics like new users or first-month revenue, the model avoided common pitfalls and focused on maximizing long-term marketing ROI. Both models were deployed and automated using Flyte on Kubernetes, enabling weekly retraining with fresh data and pushing results to a data lake for real-time reporting.

Our marketing/media mix model predicted total aggregate LTV acquired on a daily basis through a combination of marketing and non-marketing drivers.

Results

Improvement in ROAS and a strategic pivot in marketing allocation

The new insights provided by these models led to a major shift in marketing spend allocation. The analysis revealed that certain channels previously deemed effective were attracting low-value, high-churn customers, while others seen as saturated actually delivered higher customer value.

Following MMM’s spend recommendations, the client projected an increase in ROAS from 0.5-0.8x to 1.4x. Within two months of adopting the optimized spending recommendations, the client achieved a 1.5x ROAS, doubling historical returns and achieving their first quarter of positive marketing ROI. This marked the beginning of a new era of accelerated growth and customer value for the company.

Ready to unlock the full potential of data and AI?

Book a free consultation to learn how OneSix can help drive meaningful business outcomes.