Introducing Community Bank 360° for Data-Driven Growth

Written by

Mike Galvin, CEO & Co-Founder

Published

September 28, 2023

In today’s digital era, community banks face an ever-evolving landscape of challenges. Recognizing the pressing need for a dedicated solution tailored for this sector, OneSix introduces Community Bank 360°. This offering is not just a tool, but a comprehensive strategy and service offering based on our commitment to aid community banks in harnessing their data effectively.

Introducing Community Bank 360°

Community banks find themselves at a crossroads, needing to evolve and integrate new-age solutions while preserving the essence of their community-focused ethos. It’s within this backdrop that OneSix’s Community Bank 360° emerges as a beacon, offering these institutions a way forward in navigating the digital transformation journey.

Unified Data Platform

Centralized Data Management

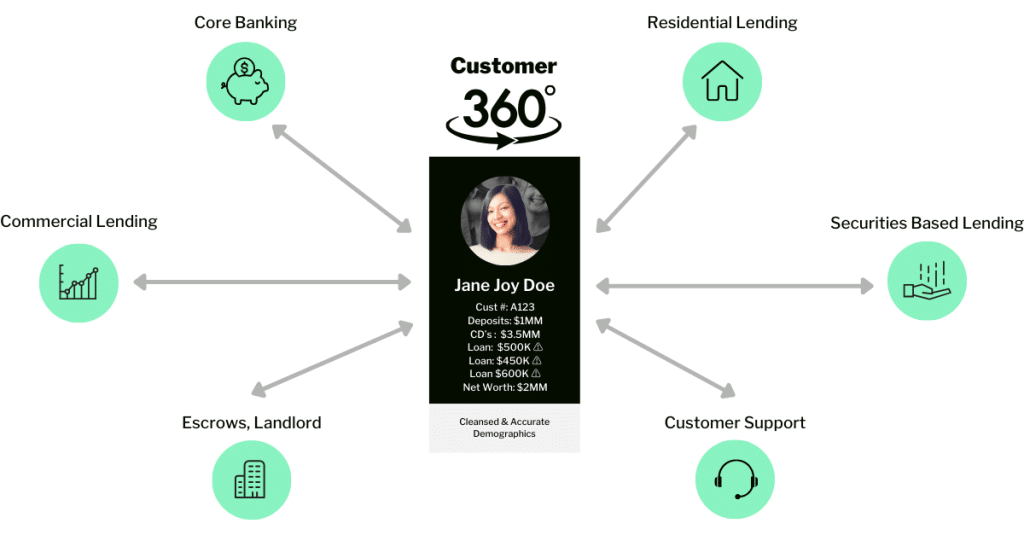

By centralizing all pertinent data, we eradicate the gaps that prevent a consolidated customer view, enabling banks to swiftly access and analyze customer information from a single point.

Master Data Management

Ensure consistency, accuracy, and reliability across your data assets. By applying advanced Master Data Management techniques, we ensure that data from various sources is coherent, reducing discrepancies and offering a single version of the truth.

In-depth Customer Analytics

Data Visualization

Visualize the customer journey like never before. With tools like Power BI and Tableau, banks can grasp complex data patterns through intuitive visuals, enabling quicker and more informed decisions.

Actionable Insights

Beyond mere data visualization, the solution extracts actionable insights. By understanding customer behaviors and preferences, banks can design strategies that resonate and effectively respond to market demands.

Scalable & Flexible Infrastructure

Cloud-Driven Solutions

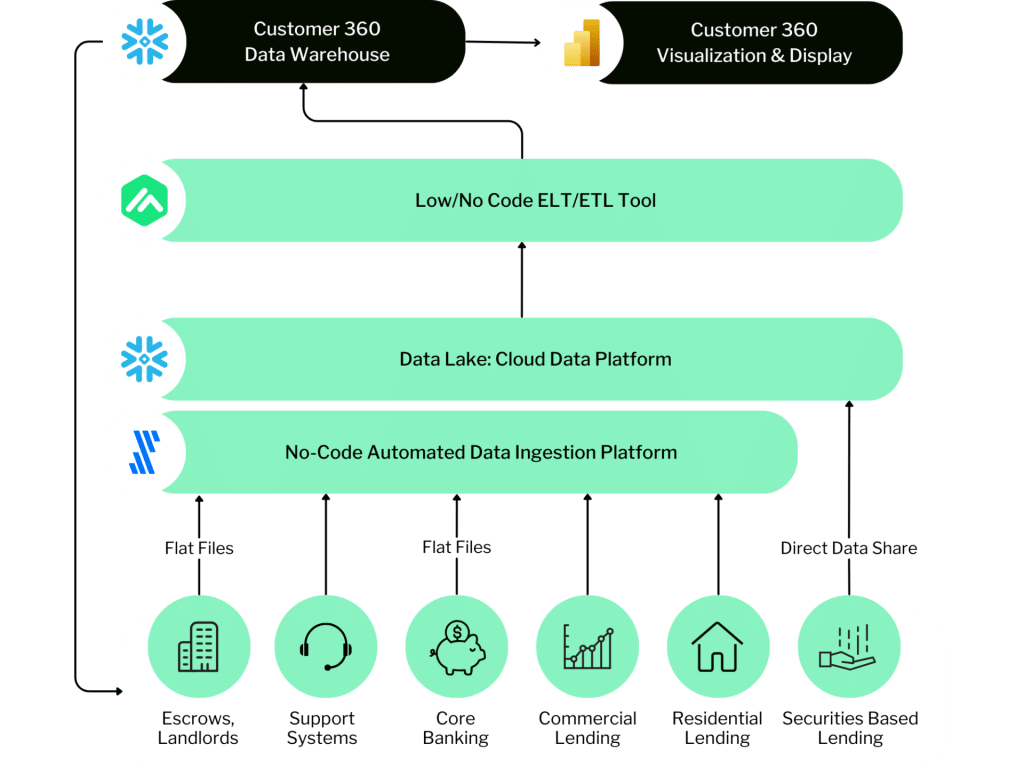

With the flexibility of the cloud, banks can scale their data operations up or down based on demand, ensuring efficiency without compromising on capabilities. This agility allows banks to adapt to changing data needs seamlessly.

Powered by Matillion

Recognizing that every community bank is unique, our solution harnesses the power of Matillion’s engine, offering the liberty to customize data processes. This means banks can mold the solution to fit their unique operational nuances and requirements.

Holistic Training & Support

Empowering Banks

The best tools are only as effective as those wielding them. We provide a comprehensive training program, ensuring your team can make the most of Community Bank 360°.

Continuous Support

Our commitment doesn’t end post-implementation. With a dedicated support team, we ensure you’re always equipped to tackle any challenges that come your way, maximizing the utility of the tool for enduring success.

Unlocking Business Outcomes

Drawing upon industry-leading insights and cutting-edge methodologies, our solution aims to elevate every facet of banking—from customer engagement and operational efficiency to growth planning and risk mitigation. By integrating this transformative approach, community banks can unlock unparalleled business outcomes:

Enhanced Customer View

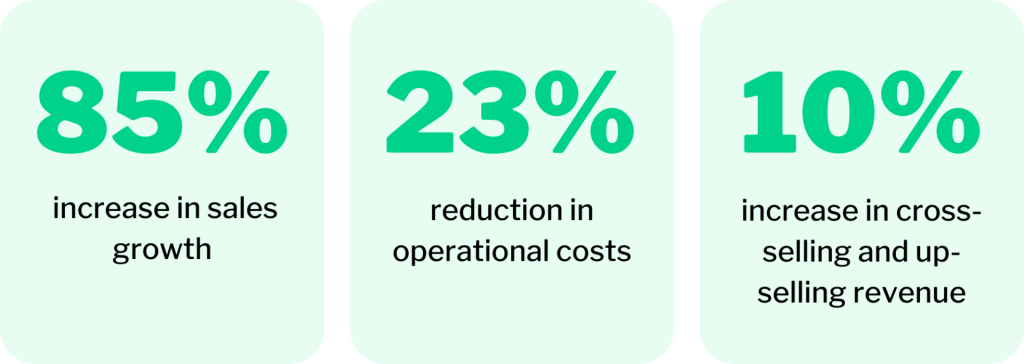

Delve into enriched customer interactions and offer banking experiences that resonate. As Forrester points out, those who tap into customer insights see a staggering 85% rise in sales growth compared to their peers.

Deeper Customer Engagement

With our 360° customer view, create tailored banking experiences, fostering enhanced loyalty and retention. Again, Forrester’s findings reinforce the value of deep customer insights, linking them to an 85% surge in sales growth.

Maximized Cross-selling and Upselling

A nuanced understanding of each customer’s journey uncovers latent opportunities, allowing banks to present relevant offerings. Such strategies, as McKinsey highlights, can amplify sales by a remarkable 10%.

Operational Streamlining

By harmonizing various processes, banks can drive down redundancies, fine-tune their workflows, and enhance decision-making. Integrating data in such a manner can precipitate cost reductions of up to 23%, as noted by IDC.

Adaptive Digital Strategy

As digital banking undergoes constant metamorphosis, our solution ensures community banks always remain a step ahead, appealing to the modern, tech-savvy customer.

Risk Mitigation & Enhanced Compliance

With a robust data framework, banks can confidently navigate the intricate regulatory maze, benefiting from improved reporting, reduced errors, and diminished compliance-associated risks.

Strategic Growth Planning

Grasping the core segments of the customer base permits banks to align their strategies with the highest growth potential sectors, optimizing the return on investment.

Personalized Marketing Campaigns

Harnessing detailed customer insights allows for the crafting of targeted marketing endeavors, which in turn, enhances engagement rates and bolsters the ROI on marketing investments.

Revolutionize Your Community Bank

Community Bank 360° is more than a tech upgrade. It equips banks with the requisite tools and insights to not only remain competitive but also to chart an innovative path towards sustainable, data-driven growth. It’s a strategic guide for community banks in a digital world. By adopting this approach, banks can not only enhance customer relations but also ensure sustainable growth in a challenging market environment.

For a deeper dive into how community banks can overcome their data challenges with Community Bank 360°, view our comprehensive guide.

Get Started

OneSix is here to help your organization build the strategy, technology, and teams you need to unlock the power of your data.