The Power of Data Centralization for PE Firms and Their Portfolio Companies

Written by

Mike Galvin, CEO & Co-Founder

Published

March 27, 2024

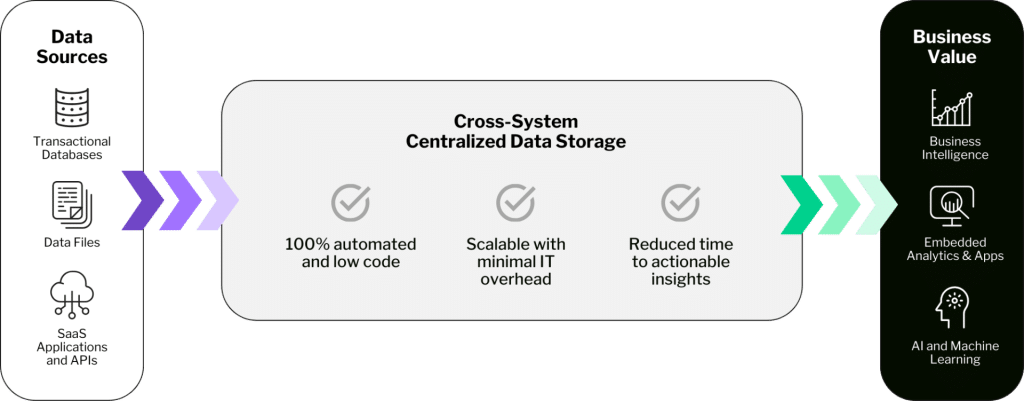

In Private Equity (PE), data has emerged as a pivotal force reshaping the industry’s dynamics. From fragmented data sources to challenges in ensuring accuracy and accessibility, private equity firms and their portfolio companies grapple with a myriad of obstacles in leveraging data effectively. However, amidst these challenges lies a transformative solution: data centralization.

Transitioning from disparate data sources to a centralized repository offers private equity firms and their portfolio companies a host of compelling advantages. By consolidating data into unified platforms, firms can unlock new opportunities for streamlining operations, enhancing decision-making processes, and ultimately reducing investment risk.

Improved Data Accessibility and Integration

Centralizing data enables private equity firms to aggregate information from various portfolio companies into a unified repository, simplifying access for stakeholders. This consolidation streamlines integration with external sources, enriching analytical insights and supporting more informed decision-making.

Enhanced Data Quality and Consistency

Centralized data management allows firms to implement standardized processes, ensuring data quality and consistency across the organization. This commitment to data integrity enhances portfolio visibility, empowering stakeholders to assess performance metrics, track key indicators, and optimize portfolio allocation strategies.

Streamlined Reporting and Analysis

Centralized data facilitates standardized reporting and analysis, enabling firms to generate customized dashboards and financial analyses efficiently. Leveraging advanced analytics tools and real-time insights accelerates decision-making processes, enhancing responsiveness to market dynamics.

Collaboration and Knowledge Sharing

Centralized data repositories serve as hubs for collaboration and knowledge sharing, fostering a culture of innovation and value creation. By providing a single source of truth for data-driven insights, firms promote cross-functional alignment and exchange of best practices, ultimately enhancing organizational agility and competitiveness.

A modern data architecture is essential for centralizing data and gaining deeper insights into overall portfolio performance. OneSix implements the infrastructure and industry-leading tools to ingest data from business applications into a single source of truth. With this approach, we can create a system that solves the needs of each portfolio company, while addressing the challenges at the PE firm level.

Your Journey Starts with a Data Maturity Assessment

Navigating the path towards data centralization can be daunting, especially for private equity firms facing diverse challenges in managing their data effectively. If you’re unsure where to begin, understanding your firm’s current data maturity level is the crucial first step.

Complete the 8-question assessment and immediately get your firm’s data maturity score and ranking, along with recommendations for how to get to the next level.

Get Started

OneSix helps companies build the strategy, technology, and teams they need to unlock the power of their data.